A Guide to Medical Indemnity Insurance in Australia

Your choice of medical indemnity insurer may potentially impact your livelihood, reputation, and savings, so it is in your best interests to investigate…

HDL Insurance Brokers

Offices in NSW, QLD and SA

HDL provides you with an informed decision making process ensuring all risk solutions address their needs ultimately providing robust balance sheet protection.

Keep up to date with the latest information from around the world.

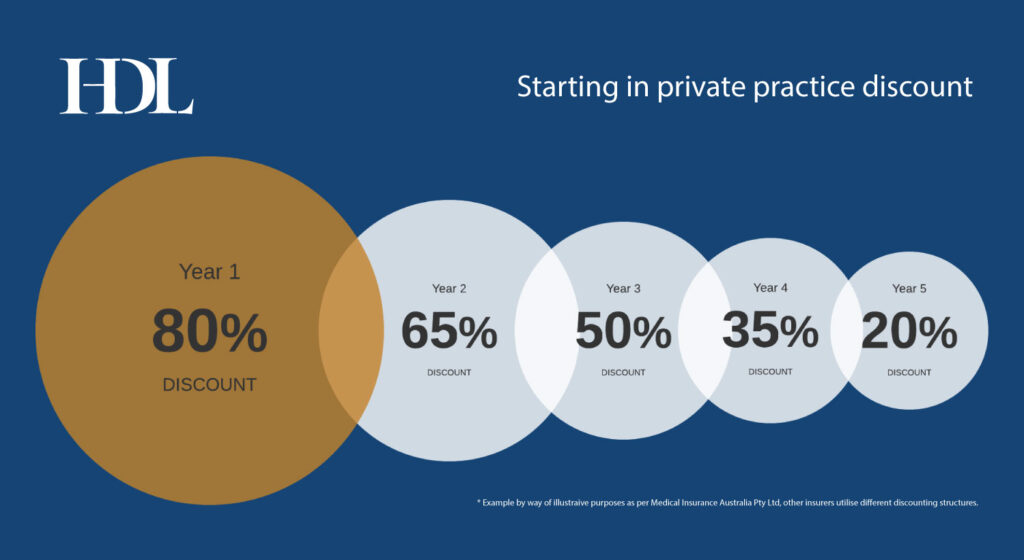

Most doctors in Australia, when they first start working in private practice, are able to access what is commonly referred to as a “starting in private practice discount”. This is a tiered discount that usually runs over 4 or 5 years. In the first year of private practice, the price paid is typically discounted by, say 80%. And then the discount may fall to 65% in the second year and by 15% per annum thereafter. Each insurer has a different approach and different scales.

But it does mean that your premiums will jump by a large percentage amount each year because, not only is the scale unwinding, but your annual billings may be rising also as your practice grows. And you also accumulate more past years of work which means your “retroactive risk of claim” will increase.

The prices that each of the six national medical indemnity insurers for doctors will charge can vary widely across each insurer based on a range of factors. And the features can also differ from insurer to insurer. And some insurers claim to offer better service or support than others.

Premiums are generally assessed by the doctor’s state of practice, specialisation, claims history and billings band.

Importantly, not all medical indemnity insurers adopt the same pricing approach and some will specifically assess your premium in accordance with your individual risk profile including actual gross private billings and sub-specialty areas. Some insurers will also require you to report any increase in income during a policy period (particularly those that adopt a billing band method) and reserve the right to seek additional premium retrospectively.

Some insurers offer significant discounts to reward compliance with certain accreditation standards or to assist doctors who are new to private practice.

Given the differences in premiums and policies, you should contact us, and our expert team can offer independent advice as to which product is best for you. If you find an insurer that better suits your needs it is possible to switch and we can advise you on this also.

Being new to private practice means your tail exposure is shorter, and with various insurers this means you pay a lower premium. Your base premium is individually calculated to reflect your practice as it changes over time including:

Each year your annual premium will be calculated to reflect the increasing tail exposure and changes to your practice.

It is important to remember that if your actual billings end up being higher than your estimate, some insurers may apply mid-term or retrospective premium increases, where others may not.

Why not let HDL do the heavy lifting for you and help you to find the most suitable insurer for you?.

Obtain a Medical Indemnity Insurance Quick Quote.

Contact HDL for further information.

Your choice of medical indemnity insurer may potentially impact your livelihood, reputation, and savings, so it is in your best interests to investigate…

Your choice of medical indemnity insurer may potentially impact your livelihood, reputation, and savings, so it is in your best interests to investigate…

The information provided in this article is of a general nature only and has been prepared without taking into account your individual objectives, financial situation or needs. If you require advice that is tailored to your specific business or individual circumstances, please contact HDL. The discount image used is for illustrative purposes as provided by MIGA, other insurers have different models that they apply.

HDL news, updates and publications may contain links to non-HDL websites that are created and controlled by other organisations. We claim no responsibility for the content of any linked website, or any link contained therein. The inclusion of any link does not imply endorsement by HDL, as we have no responsibility for information referenced in material owned and controlled by other parties. HDL strongly encourages you to review any separate terms of use and privacy policies governing use of these third party websites and resources.

Find this article helpful? Click on one of the links below to share the content.

Simply touch base with us online and one of our specialists will call you.

Professional Indemnity insurance, also known as Professional Liability insurance or Errors and Omissions cover, protects businesses that provide advice or services for a fee.

It covers claims made against you for alleged negligence or breach of duty arising from an act, error or omission in the performance of your professional advice or service.

What does Professional Indemnity Insurance Cover?

Civil liabilities claims

Arising from breach of duty, unintentional defamation, unintentional infringement of intellectual property, loss of or damage to documents.

Bodily injury and property damage claims

Arising from the professional services covered by the policy.

Legal costs and expenses

Costs of investigating, attending to court, defending and settling claims.

Public Relations expenses

Costs of engaging a public relations consultant to protect your reputation.

Estates and legal representatives

In the event of your death or incapacity, we provide cover for your estate, heirs and legal representatives for claims arising from professional services provided.

Money includes cover for loss or damage to money in transit, money in your business premises and money in a private residence which has been taken home from your business premises for safe keeping.

Typically, the following benefits apply for each of the defined events listed, up to the Sum Insured:

Money in transit:

Money contained on the Situation during Business Hours:

Money in a Locked Safe or Strongroom:

Money in custody:

Additional benefits include:

Here you can select your required coverage options. For most SME businesses, various cover options can be incorporated into a single Business Insurance Policy. Where specialised stand-alone polices are more suitable to your risks, your HDL Account Manager will ensure your policy program is structured accordingly.

Once you have selected your coverage requirements, our online quotation system will only ask the required questions needed to design the most suitable and cost effective insurance program to meet your risk needs.

Please note that a more detailed explanation can be found under the “Coverage details” section of our online quotation system.

Professional Indemnity covers claims made against you for alleged negligence or breach of duty arising from an act, error or omission in the performance of your professional advice or service.

Public & Products Liability includes cover for amounts which your business is legally liable to pay for personal injury or property damage that occur in connection with your business activities or caused by products sold or supplied by your business.

Contents and stock includes cover for loss or damage to your business contents and stock caused by accidental damage, fire, storm, wind, water and / or other insured perils.

Glass includes cover for accidental breakage of fixed external glass and internal glass counters, shelving, interior showcases, fixed mirrors, toilet pans and basins.

Theft includes cover for loss or damage to contents and/or stock from theft, attempted theft, armed hold up or actual / threatened assault.

Buildings includes cover for you for the cost of repairing or reconstructing building/s your business owns as a result of fire and / or other insured perils.

Business Interruption includes cover for the loss of gross profit / revenue from the interruption or interference with your business caused by an insurable event such as fire, storm, malicious damage, accidental damage and theft.

Money includes cover for loss or damage to money in transit, money in your business premises and money in a private residence which has been taken home from your business premises for safe keeping.

Tax Audit covers a business for specified costs in responding to an official tax audit and other official investigations.

Cyber Liability Providing cover for first-party expenses and third-party liability from unauthorised access and use of data or software in your IT infrastructure.

Electronic Equipment This cover provides repair or replacement of Computer and Electronic Equipment following breakdown.

Employee Dishonesty covers financial loss from dishonesty of employees.

General Property (Also known as Portable Property) includes cover for loss or damage to your mobile plant, equipment and tools arising from a sudden and unforeseen accident anywhere in Australia from fire, storm, water and other perils and theft following forcible and violent entry to a locked vehicle or tool boxes.

Machinery Breakdown covers you for breakdown of machinery and for physical loss or damage to other property as a result of that breakdown.

Management liability insurance protects directors, managers and employees and the insured company itself from the many exposures relating to the management of a company. Owners and those responsible for the management of a company have specific responsibilities which can result in personal liability for alleged or actual wrong doing.

Personal Accident covers your income and provides benefits for permanent disability and even death if you’re unable to work due to illness or injury.

Transit covers you for loss or damage to your property or goods whilst in transit.

This section is designed to provide basic information about your business.

Business Name – This should be your business or company trading name.

When would you like your policy to start? – Select the date you would like your policy to start. If you already have a policy in place you’ll want to make sure there is no gap in coverage. Note that the expiry date is automatically entered based on an annualised policy anniversary date.

Address – This is your main business location, not your postal address. Simply start typing your address using our google address search capabilities. Once selected you will be asked to confirm the address is correct, and you have the opportunity to make adjustments.

If you don’t have a business premises such as a shop or office, use your home location.

Please provide us with details on how we can contact you.

Name – Please enter your First and Last Name.

Email – We’ll use your email to send across your quote details to you or to request any further information if required.

What is your best phone number to contact you – You need to provide at least one contact number, either Mobile or Office Phone or both.

We’ll use the number(s) entered so your personal account manager can call and go through your quote and answer any questions you may have.

Terms of use and Privacy Policy acceptance – Before proceeding please read our Terms of Use and Privacy Policy.

This section is designed to ask specific questions relating to each coverage option selected.

Please click on the dropdown arrows to expand each section and answer the required questions.

Includes cover for amounts which your business is legally liable to pay for personal injury or property damage that occur in connection with your business activities or caused by products sold or supplied by your business.

Personal Injury or Property Damage may be caused by:

Products liability covers you and your Business in the event that your product/s were to cause Personal Injury or property Damage.

Personal Injury or Property Damage may be caused by:

Damage to property while in your physical or legal control is provided up to certain limits, depending on your occupation and if any endorsement is applied.

Contents and stock includes cover for loss or damage to your business contents and stock caused by accidental damage, fire, storm, wind, water and / or other insured perils.

Buildings includes cover for you for the cost of repairing or reconstructing building/s your business owns as a result of fire and / or other insured perils.

There are a number of additional benefits which are available:

Is EPS or any other form of insulated sandwich panel present within the building?

Commonly used as a cost effective insulation material for coolrooms and cleanrooms, EPS – Expanded Polystyrene Sandwich panel consists of an outer covering of sheet metal & core commonly filled with expanded polystyrene, polyurethane foam, expanded composite phenolic foam or other material as an insulating medium.

The most common material used in Australia are Expanded (XPS), Extruded Polystyrene (EPS), Polyurethane (PUR) or Polyisocyanurate (PIR).

Glass includes cover for accidental breakage of fixed external glass and internal glass counters, shelving, interior showcases, fixed mirrors, toilet pans and basins.

Internal Glass includes:

External Glass includes:

Additional benefits of Glass cover include:

Additional benefits are also covered up to certain limits for any one event, plus;

Theft includes cover for loss or damage to contents and/or stock from theft, attempted theft, armed hold up or actual / threatened assault.

Tobacco and alcohol cover is suited to businesses that carry Tobacco and/or Alcohol as Stock, and needs to be insured separately under this Section.

Cover can also include:

Business Interruption includes cover for the loss of gross profit / revenue from the interruption or interference with your business caused by an insurable event such as fire, storm, malicious damage, accidental damage and theft.

It’s designed to assist your business to recover from an insured event by paying ongoing expenses (such as wages or rent).

When selecting the sum insured, please refer to the following. Please note that Business Interruption calculations can become complex, and your personal account manager at HDL has the expertise to calculate this for you, so please reach out to discuss.

Loss of Gross Profit

One option is to insure your business against loss of gross profit Annual Gross Profit which is the sum of your Turnover, Closing Stock & Work in Progress, less the sum of your Closing Stock & Work in Progress. This has no relation to your taxable gross profit, either net or gross. In certain situations you may wish to nominate some expenses that you do not wish to insure, which we refer to as Uninsured Working Expenses. Uninsured Working Expenses are the costs/expenses that vary depending on the level of trading and can include the purchase of raw materials, components, freight, packaging, commissions, discounts allowed and payroll.

Loss of Gross Revenue

For businesses in service-based industries with few variable expenses (e.g., solicitors, investment consultants, and medical and health consultants), it may be appropriate to insure for loss of gross revenue. The insured value is generally calculated by taking the turnover from the last year and applying the expected growth for the upcoming period.

Businesses insure loss of gross revenue for a relatively short indemnity period of 3 or 6 months if they anticipate a rapid return to pre-loss trading (e.g., an office-based business with a catastrophic loss to their premises may secure replacement office space, IT equipment etc. and resume full scale trading relatively quickly). In this situation, it is also important to consider a sufficient AICOW coverage limit to cover increased costs associated with the lease of temporary premises, office equipment and employment of additional staff and/or contractors.

Loss of Gross Rentals

This type of cover is designed to respond to loss of rental income to a landlord or property owner. It is important to note that the insured value should include the net rent receivable AND the outgoings paid by the tenant which would be payable by the policyholder if the lease were suspended or terminated.

As with the other coverage options, Loss of Gross Rentals should be considered in conjunction with Additional Increased Costs of Working cover (for items such as advertising costs, contractors’ overtime costs, or rent-free periods for tenants etc.).

Additional Increased Costs of Working

This covers the costs to avoid or limit reduction in revenue and resuming or maintaining normal business operations. This can include leasing of temporary premises, leasing of plant and equipment, overtime payments and temporary employment of additional staff.

Claims Preparation Costs

The insurance under this item is to cover such reasonable professional fees as may be payable by the Insured, and such other reasonable expenses necessarily incurred by the Insured and not otherwise recoverable, for preparation of claims under the Insured’s Material Damage and Business Interruption insurance policies.

Accounts Receivables

The insurance under this item is limited to the loss sustained by the Insured in respect of all outstanding debit balances if the Insured is unable to effect collection thereof as a direct result of Damage to records of accounts receivable.

Indemnity Period

The indemnity period is the period which the insurance policy will provide cover for disruption to your business. It not only covers the period which it takes to rebuild a damaged building or replace stock etc. it is the period which you expect the business will take to be back exactly where it was at the time of the loss. This means getting back or replacing any lost customers and/or protection for any on-going increased costs of working to the business.

Tax Audit covers a business for specified costs in responding to an official tax audit and other official investigations.

Tax Audits are not always limited to the current year, and businesses are occasionally subject to an audit of prior years, which may require significant amount of preparation costs to meet your obligations to the statutory authority requesting the Audit.

Some of these costs that your Business may incur include:

If your Business is audited, there are likely to be significant costs relating to the Audit, including fees for tax agents, financial advisors, auditors, accountants and solicitors that are your employees. There are often costs attached to preparing for the Audit, including staff overtime and travel. This is where Tax Audit can help protect you.

This section provides the required information about your business operations.

Do you earn revenue outside of Australia? – If you earn revenue outside of Australia please select yes.

With respect to your Australian operations, do you perform business in..?

Turnover from operations in other states will impact your stamp duty charges and any waiver eligibility.

Projected annual turnover – This is the estimated total amount of revenue in the next 12 months from all sales and/or services that your business carries out.

In which countries are you located? – If you have a physical presence (employees) in other countries, please select yes.

Total number of employees (incl. owner) – Do not include contractors. If you are a sole trader you should enter 1 in the field. If you have part-time workers 1 full-time equivalent worker = (Total Part Time hours over 1 week) ÷ 38.

Electronic Equipment This cover provides repair or replacement of Computer and Electronic Equipment following breakdown.

This cover is suitable to those businesses who need to insure computers and Electronic Equipment at their business premises against Breakdown, but not against Accidental Damage or loss. For Damage or loss cover, please consider insuring under General Property or Building and Contents.

To help You obtain the right level of cover, We’ve provided two coverage options which require You to set a Sum Insured for either, or both:

Computers

Providing cover for Breakdown for Computers that can be carried by hand and weigh less than 5 kilograms

Electronic Equipment items

Including but not limited to any electronic machine, device including those used for research, medical, telecommunication transmission, audio visual and office machines.

This cover also provides a number of additional benefits highlighted in the summary below:

Employee Dishonesty covers financial loss from dishonesty of employees.

Coverage generally extends to, depending on the insurer, loss of money, contents or stock and electronic equipment by any of your employees either acting alone or in collusion with others.

General Property (Also known as Portable Property) includes cover for loss or damage to your mobile plant, equipment and tools arising from a sudden and unforeseen accident anywhere in Australia from fire, storm, water and other perils and theft following forcible and violent entry to a locked vehicle or tool boxes.

To help you obtain the right level of cover, We’ve provided options to allow you to easily select the cover for Unspecified Items to include Specified Items if required.

Unspecified Items include:

Specified Items include:

Electronic items, computers, photographic equipment, mobile phones, faxes, multi-scanners and similar equipment, plus other items which are of a value greater than $2,500.

In the description, it’s important you note the make and models of the items you’re insuring, to enable correct claims identification assessments.

Cover applies to Accidental Damage anywhere in the world unless amended by an endorsement which will be shown in Your Schedule.

Machinery Breakdown covers you for breakdown of machinery and for physical loss or damage to other property as a result of that breakdown.

You have several options including:

Blanket cover (for individual items worth less than $2,500)

Machinery Breakdown works to cover all Machinery at your Business premises, except for those excluded under the PDS. For example, computers, communication equipment, and audio visual items are generally excluded by insurers. However, if you would like to cover these items Electronic Equipment coverage may be a suitable option.

To ensure you’re adequately covered, You need to set a blanket cover amount in the “maximum any one loss field”. Remembering, that insurers generally place a limit of $2,500 for any one item. This will mean that all your equipment is covered up to the amount selected, except for those excluded or impacted as listed in the PDS.

Specified Items cover (for individual items worth more than $2,500)

Here you can specify any individual items, that are valued above $2,500.

Do you require cover for deterioration of refrigerated goods?

Provides additional cover for physical loss or damage to refrigerated goods owned by you. When selecting the sum insured, consider the purchase price of refrigerated goods plus the cost of disposal.

Machinery Breakdown cover also provides a number of additional benefits highlighted in the summary below:

Personal Accident covers your income and provides benefits for permanent disability and even death if you’re unable to work due to illness or injury.

Information relating to each specific question is summarised below to assist.

Full name of the Insured Person

Cover only applies to the individual named in the policy. Each individual must be an Australian resident or domiciled in Australia.

Date of Birth

We need to capture the age of the insured person as Insurers will only cover people under a certain age. This age varies from 60 to 70 years old.

What type of Personal Accident Cover would you like?

You can choose to have weekly benefits paid to you resulting from an Injury only or an Injury and a Sickness. The Sickness, disease or degenerative condition can’t be pre-existing and must first occur during the period of insurance.

Benefit Period

The Benefit Period is the maximum period for which you can receive the weekly benefit payment.

Waiting Period

The waiting period (or excess period) is the period of consecutive days stated in the policy during which no Benefits are payable for a Bodily Injury or Sickness. The period starts from the day medical treatment is sought from a Medical Practitioner or after you are totally disabled as a result of Injury or Sickness.

What level of cover for Accidental Death & Disability would you like?

Subject to the policy terms, conditions & exclusions, accident death or permanent total disablement provide for a lump caused solely by accident.

What weekly benefit amount would you like to insure?

Maximum sum insured can be up to 85% of your weekly earnings. This is the maximum amount that can be paid out to you on a weekly basis. The actual amount payable in the event of a claim will be subject to the policy terms, conditions & exclusions, and may be less than the maximum amount depending on your actual substantiated earnings over the 12 months immediately prior to the disablement.

If you are self-employed, in determining the weekly earnings amount you wish to select consider your gross weekly income less costs and expenses other than fixed business expenses incurred in deriving that income.

If you are employed, in determining the weekly earnings amount you wish to select consider your gross weekly income less any overtime payments, commissions, bonuses and allowances in deriving that income.

There are different types of marine-related insurance policies, and the type you choose will vary based on your specific needs. Some business package policies can include transit cover, however coverage is generally restricted to Specified Perils and restricted to Australia Wide. Broader Accidental Damage cover can be provided through specialised Marine Transit policies and can provide Worldwide protection for imports and exports.

What type of cover do you require?

Specified Perils – Covers you for loss and damage to your property in transit caused by collision, fire and other perils, malicious damage and theft.

Accidental Damage – Physical damage that occurs as a result of an unexpected and non-deliberate external action.

Geographic Limits

Australia Wide – Covers your goods or other people’s goods being transported by you or professional carriers. Goods in transit could include stock, items held for service or repair and customers goods.

Worldwide – imports & exports – Covers Damage to Property Insured whilst being imported or exported to/from Australia.

Our final couple of housekeeping questions.

Note that this question is only asked if you have told us your business is located in NSW.

Are you eligible for the NSW Small Business stamp duty exemption?

If your business is located in NSW, are you eligible for the NSW Small Business Stamp Duty Exemption i.e. you are a NSW based small business with turnover of less than $2 million per annum?

What is the NSW Small Business Stamp Duty Exemption?

The NSW Government has created a small business stamp duty exemption in the Duties Act 1997 (NSW) (the Act) for eligible insurance acquired on or after 1 January 2018. In order to get the benefit of the exemption, you must:

What types of insurance are eligible for the exemption?

The types of insurance that may be eligible include:

Special definitions apply to each of these insurances so you should refer to section 259B of the Act for those definitions. Insurers will only apply the exemption where they determine the policy is effected (in whole or part).

When does the exemption apply?

The exemption applies if the eligible insurance is in a contract effected (new business and variations) or renewed on or after the 1 January 2018.

Definition of a small business

NSW Insurance Stamp Duty legislation is complex and insurers are not permitted to assist you in determining if you are eligible for the exemption. We recommend you seek professional advice to determine whether the exemption applies to you.

The small business definition would usually capture an individual, partnership or trust carrying on a business where their aggregated turnover (as defined in the Act) in the relevant period is less than $2 million. There are several options to determine how the “relevant period” is defined.

Please see section 259A of the Duties Act 1997 for full details and/or seek appropriate advice.

For more information please refer to https://www.hdlbrokers.com.au/sme-insurance/nsw-small-business-stamp-duty-exemption/

New legislation continues to be enacted imposing tougher than ever restrictions and obligations on management, and employees appear increasingly more knowledgeable of their rights in the workplace, yet a majority of directors and officers may not have adequate management liability insurance in place.

Coverage is designed to provide flexible and comprehensive protection and the services to cope with the downsides that occur in business, particularly in the increasingly litigious modern-day environment.

Coverage includes:

Management Liability:

Broad cover for costs associated with defending directors, managers and employees against claims arising from their actions and decisions.

Corporate Liability:

Protection for the business from claims of wrongful management, plus coverage for the accidental death of a director, and PR costs to prevent damage to or restore business reputation in the event of a crisis.

Employment Practices Liability:

Protects the business from claims for wrongful dismissal or discrimination by past and present employees, customers or suppliers.

Crime:

Protecting the balance sheet from fraudulent or dishonest activities carried out by employees or outside third parties.

Superannuation Trustees Liability:

Protection for the business, trustees, employees and the fund itself against claims brought in relation to wrongful acts involving a plan, whether actual or merely alleged.

Statutory Liability:

Protecting both individuals and the entity against fines and pecuniary penalties.

Providing cover for first-party expenses and third-party liability from unauthorised access and use of data or software in your IT infrastructure.

Coverage includes:

Point of Sale (PoS) Intrusions

Remote attacks against retail transactions for card-present purchases.

Physical Theft and Loss

Incidents where information assets go missing, through misplacement or malice.

Cyber Espionage

Unauthorised network or system accesslinked to state-affiliated or criminal sources with the motive of espionage.

Hacking/Crimeware

Malicious or unauthorised IT infrastructure access or malware that aims to gain control of systems.

Miscellaneous errors

People make mistakes. Unintentional actions directly compromising security attributes of information assets.

Insider and privilege misuse

Unapproved or malicious use of organisations’ resources by insiders or external misuse through collusion.

Cyber extortion

Attacks or threatened attacks against IT infrastructure, coupled with demands for money to stop attacks.

Payment card skimmers

Skimming devices physically implanted on assets that read magnetic stripe data from payment cards.

Web app attacks

Exploiting code-level vulnerabilities in applications and thwarting authentication mechanisms.

Privacy error

Your acts or omissions that lead to unauthorised disclosure of data including non-electronic data.

Denial of service (DoS)

Intentional compromising of networks and systems’ availability. Includes network and application layer attacks.

Optional coverage for:

Contingent Business Interruption cover

Cover costs caused by supplier outage or system failure.

Criminal Financial Loss

Covering direct financial loss to you and others arising out of:

Tangible Property Cover

Covering the cost of the replacement or repair of your IT hardware that is physically damaged or no longer suitable for use solely and directly because of a cyber event.

Join Venture and Consortium Cover

Cover is extended to your participation in a joint venture or consortium you have declared to us.

This website uses cookies. We use cookies to help give you the best experience on our website, deliver our services, personalise content and to analyse traffic. By continuing to use our website, you agree to allow our use of cookies. To know more, please refer to our Cookie Policy, which is part of our Privacy Policy.

This website uses cookies. We use cookies to help give you the best experience on our website, deliver our services, personalise content and to analyse traffic. By continuing to use our website, you agree to allow our use of cookies. To know more, please refer to our Cookie Policy, which is part of our Privacy Policy.